By: Swarnalata

Published on: Jun 16, 2025

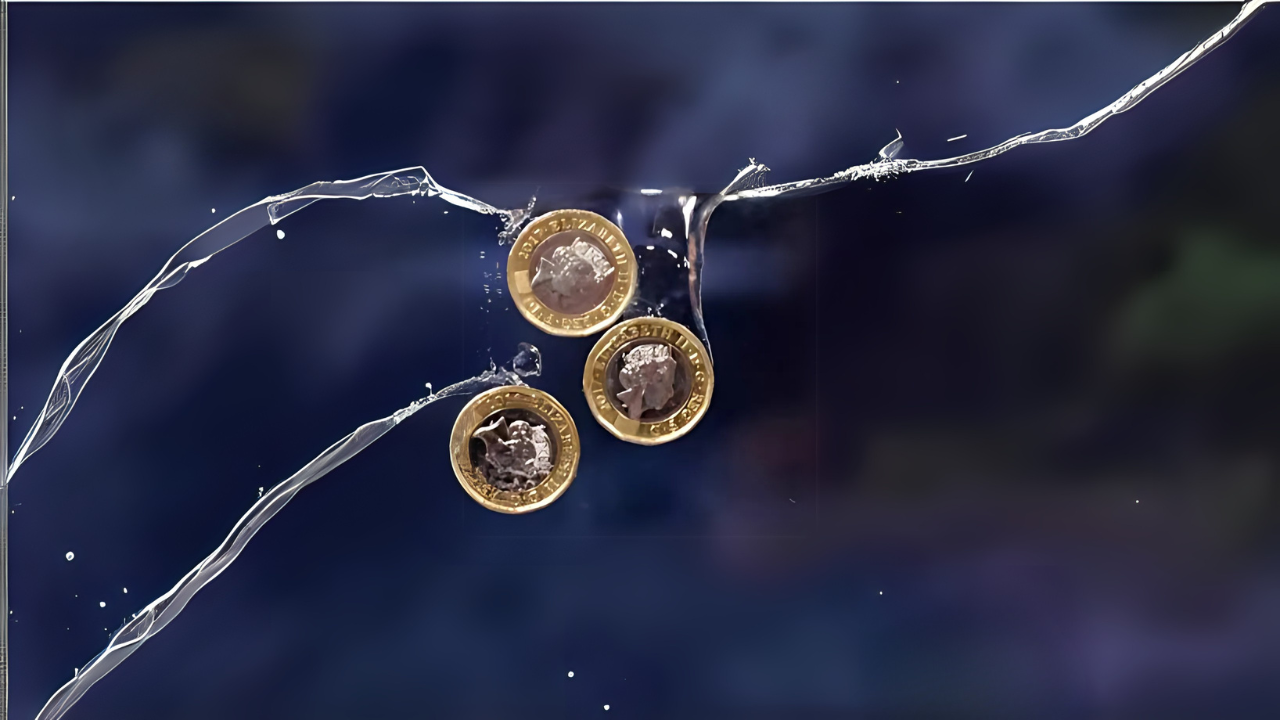

As the UK braces for the Bank of England's next interest rate decision, many households are actively seeking ways to make their cash reserves work harder. Amid a lingering cost-of-living crisis, high-yield savings accounts are proving to be an effective tool for consumers seeking to counteract inflation and secure better returns on their money. Despite the recent cut in the base rate to 4.25%, competitive fixed-rate and easy-access savings products are still available — but time may be running out.

Following a period of rate hikes to combat inflation, the Bank of England (BoE) has now reduced the base rate to 4.25%. While this brings some relief to borrowers, savers are beginning to feel the squeeze. Inflation rose to 3.5% in April, up from 2.6% in March, which is significantly above the BoE’s 2% target. This environment calls for strategic savings decisions, as many accounts now fail to keep pace with inflation.

According to ONS data, this was the highest inflation level since February 2024, suggesting rising prices are still eroding the value of unoptimized cash holdings. As such, financial experts recommend reviewing savings portfolios regularly and shifting funds to accounts offering rates that outpace inflation.

“Don’t assume your high street bank will give you a good deal,” said Victor Trokoudes, CEO of Plum. “You have to do your research to find the highest interest rates!”

Bank of England figures show that household deposits with banks and building societies increased by £3bn in April, although this was down from £7.3bn in March. A key trend was the shift in deposits into Individual Savings Accounts (ISAs), with £14bn newly invested, indicating a growing appetite for tax-free interest. Meanwhile, interest-bearing sight accounts lost £11.5bn, and non-interest accounts lost another £6.3bn.

This movement suggests that more savers are becoming rate-savvy, but there’s still work to be done. If your cash is languishing in an old account paying less than 2%, you’re losing money in real terms.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, highlighted the opportunity:

“Some consumers may have been taking advantage of higher savings rates while they were still around. As the BoE’s rate-cutting cycle unfolds, many providers have already begun reducing rates.”

Despite this, the effective rate on new savings accounts rose to 4.02% in April, suggesting competition is still strong, for now.

When comparing savings products, the key trade-off is accessibility vs. returns. Here are the two main options:

These allow you to deposit and withdraw money freely without penalties. They are ideal for emergency funds or flexible saving. However, they often offer lower interest rates, and these rates can change at short notice.

With these, you agree to lock your money away for a set period, typically 1 to 5 years. In return, you often get higher interest rates. These are best suited for long-term savers who do not need immediate access to their funds.

Pro Tip: Always check whether interest is paid monthly or at maturity, as this can impact your compounding returns or cash flow.

Here are some of the top savings accounts currently available that beat the inflation rate and deliver strong fixed returns:

With the BoE due to announce its next decision on Thursday, analysts are split on whether another rate cut is likely. Continued geopolitical instability and uncertain inflationary pressures mean the BoE may take a cautious stance.

Should rates fall further, we could see savings products quickly follow suit. Therefore, locking in current rates — especially on fixed-term accounts — might prove to be a timely move.

The recent economic turbulence has highlighted the importance of smart cash management. Even with the BoE cutting interest rates, savers still have several strong opportunities to beat inflation and grow their wealth safely. Whether through high-yield fixed accounts or savvy use of ISAs, proactive savers can position themselves to make the most of their money in 2025.

As always, read the fine print, compare platforms, and make sure your savings are aligned with your short-term and long-term goals.

Comments

No comments yet. Be the first to comment!

Leave a Comment