By: Swarnalata

Published on: Jun 14, 2025

Bitcoin (BTC), the world's largest cryptocurrency, saw a sharp rebound to $106,000 on Friday after earlier tumbling to around $102,600 due to escalating tensions between Israel and Iran. Despite the temporary recovery, market experts remain cautious, warning of a potential deeper correction in the coming days.

The sharp volatility in the crypto market was triggered by breaking news of airstrikes between Israel and Iran, reigniting geopolitical fears and prompting a sell-off in risk assets, including digital currencies. Bitcoin initially slumped under the pressure but regained some ground, reflecting the market's typical knee-jerk reaction to uncertainty before settling.

As of late Friday, Bitcoin was trading at approximately $105,200 — down 1.6% over the past 24 hours and still trailing its all-time high by less than 6%. The rebound from the $102,600 mark shows resilience, but the broader mood remains wary.

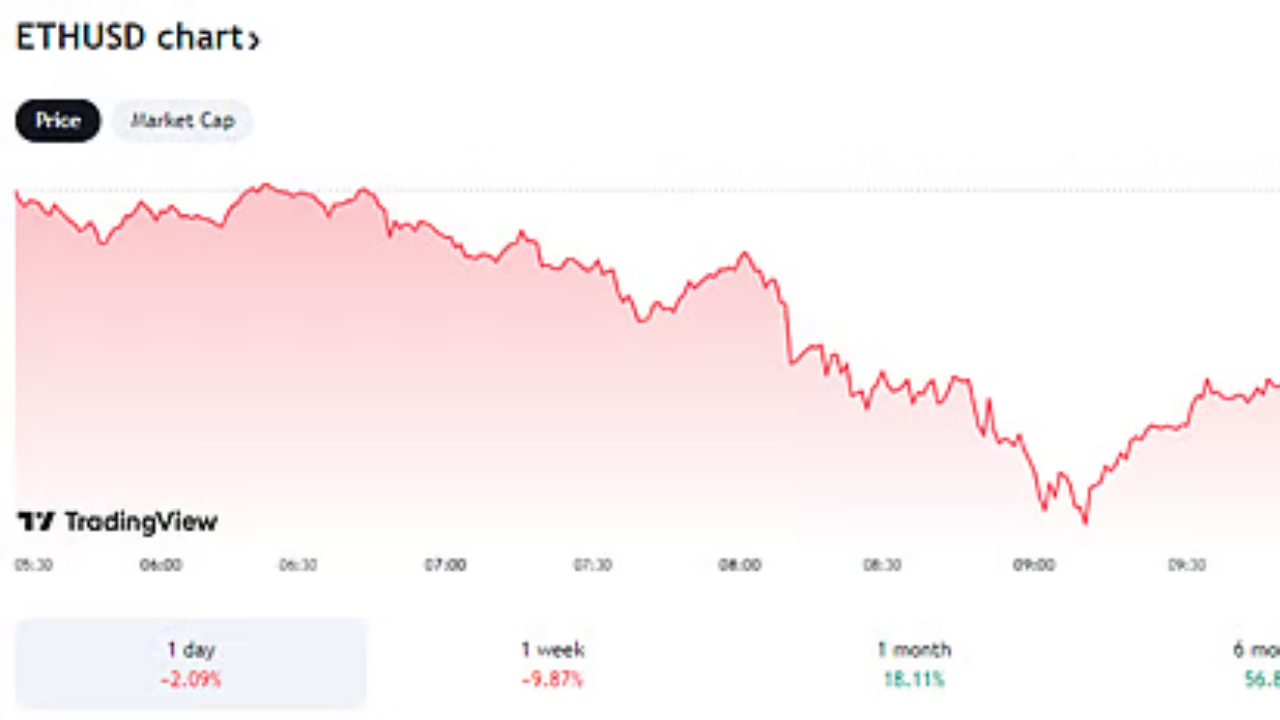

Meanwhile, the CoinDesk 20 Index, which tracks the top 20 cryptocurrencies excluding stablecoins and meme coins, dropped by 4.4% over the same period. Ethereum (ETH), Avalanche (AVAX), and Toncoin (TON) led the declines, falling between 6% and 8%.

Crypto traders initially panicked over the renewed Iran-Israel conflict, which injected significant uncertainty into markets already grappling with macroeconomic and monetary policy concerns. Bitcoin, known for its sensitivity to geopolitical instability, quickly responded with a dip, only to stage a partial recovery as the news was digested.

The volatility wasn’t limited to cryptocurrencies. Publicly traded crypto firms also took a hit. Bitcoin mining companies like MARA Holdings and Riot Platforms saw their shares drop 5% and 4%, respectively. The recent price action has added further pressure to miners already dealing with tightening profit margins post-halving.

One standout exception was Circle (CIRCL), the stablecoin issuer that recently went public. Circle’s stock surged by 13% on Friday, driven in part by positive sentiment around its IPO and reports that retail giants Amazon and Walmart are exploring stablecoin-based solutions — possibly looking to leverage USDC in payment ecosystems.

While crypto traders reacted sharply, traditional markets were relatively muted. The S&P 500 and Nasdaq fell just 0.4% each, suggesting that equities investors are not yet pricing in major geopolitical risks. Gold, however, rose 1.3%, signaling increased demand for safe-haven assets and positioning itself for a possible breakout to new all-time highs.

The divergence between traditional financial markets and the crypto sector reveals that while geopolitical instability can rattle risk assets like Bitcoin, its broader implications for traditional markets may still be developing.

Despite the modest bounce, many crypto analysts are urging caution. Popular crypto trader Skew noted in a post on X that the rebound lacks meaningful follow-through and that Bitcoin remains tightly correlated with traditional markets, especially during periods of geopolitical uncertainty.

From a technical standpoint, analysts are beginning to question whether Bitcoin's recent drop indicates a failed breakout.

Markus Thielen, founder of 10x Research, warned that Bitcoin falling below the $106,000 mark could signal a failed breakout and suggests traders wait for clearer bullish setups before attempting to buy the dip. He also pointed to the $100,000–$101,000 zone as a critical support area. A breakdown below this range could mean that Bitcoin is re-entering a consolidation phase similar to that of mid-2024.

John Glover, Chief Investment Officer at crypto lending platform Ledn, went a step further, suggesting that the correction might deepen. He believes Bitcoin could fall to the $88,000–$93,000 range as part of a broader correction from recent record highs.

Sentiment indicators and on-chain metrics reflect growing anxiety in the market. Fear and Greed Index readings have pulled back from “Extreme Greed” territory, and funding rates on crypto futures markets have normalized, indicating less leveraged bullishness from traders.

Long-term investors, however, are not panicking. Many remain optimistic, citing ongoing institutional interest, the long-term deflationary model of Bitcoin post-halving, and increasing global adoption as structural supports for the asset.

That said, in the near term, caution is expected to prevail, especially over the weekend, as traders watch for further developments in the Middle East and their impact on both traditional and digital assets.

Here are key technical and macro levels to watch in the days ahead:

Additionally, developments around stablecoins and mainstream retail partnerships, such as those involving Circle, could serve as a counterbalance to bearish pressures and support sector-wide recovery.

Bitcoin’s bounce back to $106,000 following geopolitical jitters between Iran and Israel shows resilience, but analysts aren’t ruling out a deeper pullback. With the market showing signs of nervousness and traditional assets largely unfazed, Bitcoin’s trajectory in the coming weeks will depend heavily on both geopolitical stability and broader macroeconomic signals.

For investors and traders, the next few days are crucial. The technical setup, coupled with fundamental geopolitical risks, suggests staying nimble and avoiding overly aggressive positions until clarity emerges.

Comments

No comments yet. Be the first to comment!

Leave a Comment