By: Swarnalata

Published on: Apr 09, 2025

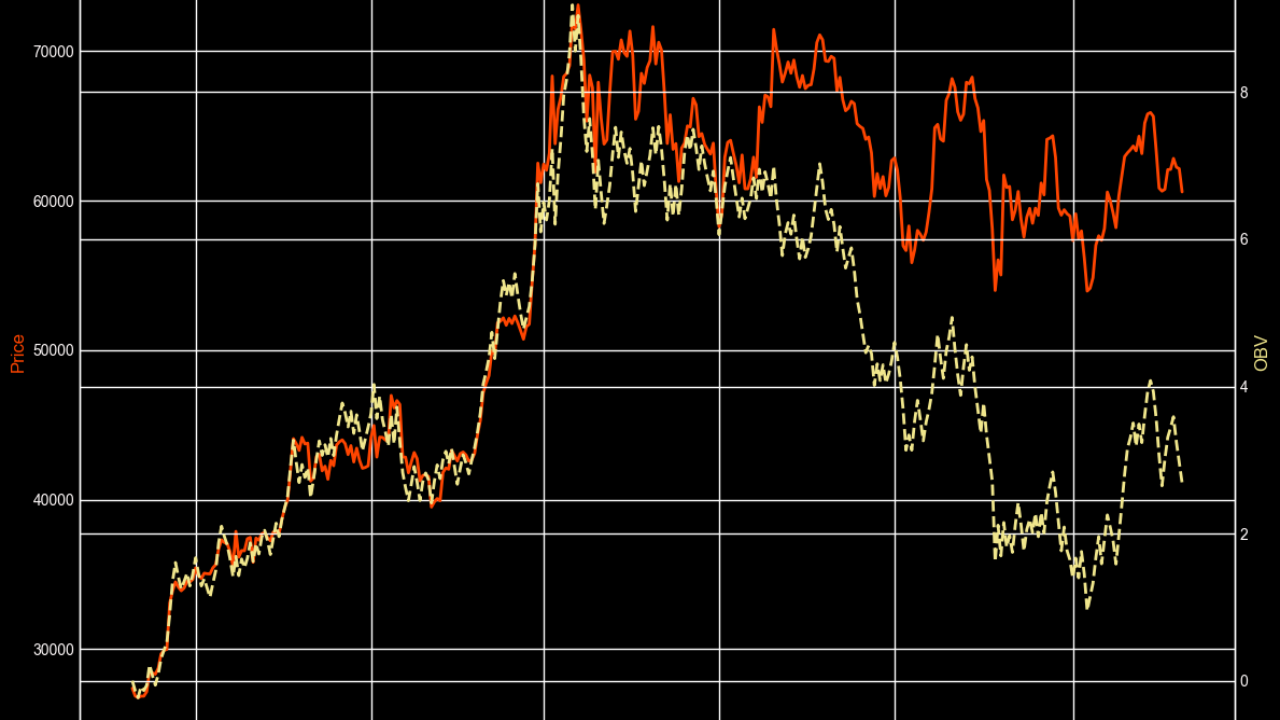

Bitcoin (BTC) has rebounded from a brief selloff, demonstrating its resilience as global markets react to escalating U.S. trade tariffs. While traditional assets like stocks and bonds face heavy selling pressure, cryptocurrencies are emerging as a potential hedge against economic uncertainty.

As of 6:30 a.m. New York time, Bitcoin was trading around $77,200, recovering from an earlier 3.2% dip. Meanwhile, Ether (ETH), the second-largest cryptocurrency, stabilized after hitting its lowest level since March 2023.

Amid the market chaos triggered by new U.S. tariffs, Bitcoin’s relative stability has reinforced its appeal as a hedge against macroeconomic risks. According to Joel Kruger, Market Strategist at LMAX Group, Bitcoin’s strong performance highlights its growing role in diversified portfolios.

“Investors are increasingly waking up to Bitcoin’s underlying value proposition, particularly its allure as a hedge during times of global market turbulence,” Kruger noted.

Despite Bitcoin’s rebound, analysts warn of continued volatility in the crypto market. Sean McNulty, Head of Asia Pacific Derivatives at FalconX, reported increased demand for Ether and Solana (SOL) put options, signaling cautious investor sentiment.

McNulty also identified $65,000 as the next key support level for Bitcoin, suggesting potential downside risks if market conditions worsen.

“It seems like people have given up on a major crypto recovery in the first half of the year,” he added.

Comments

No comments yet. Be the first to comment!

Leave a Comment