By: Payel

Published on: Mar 08, 2025

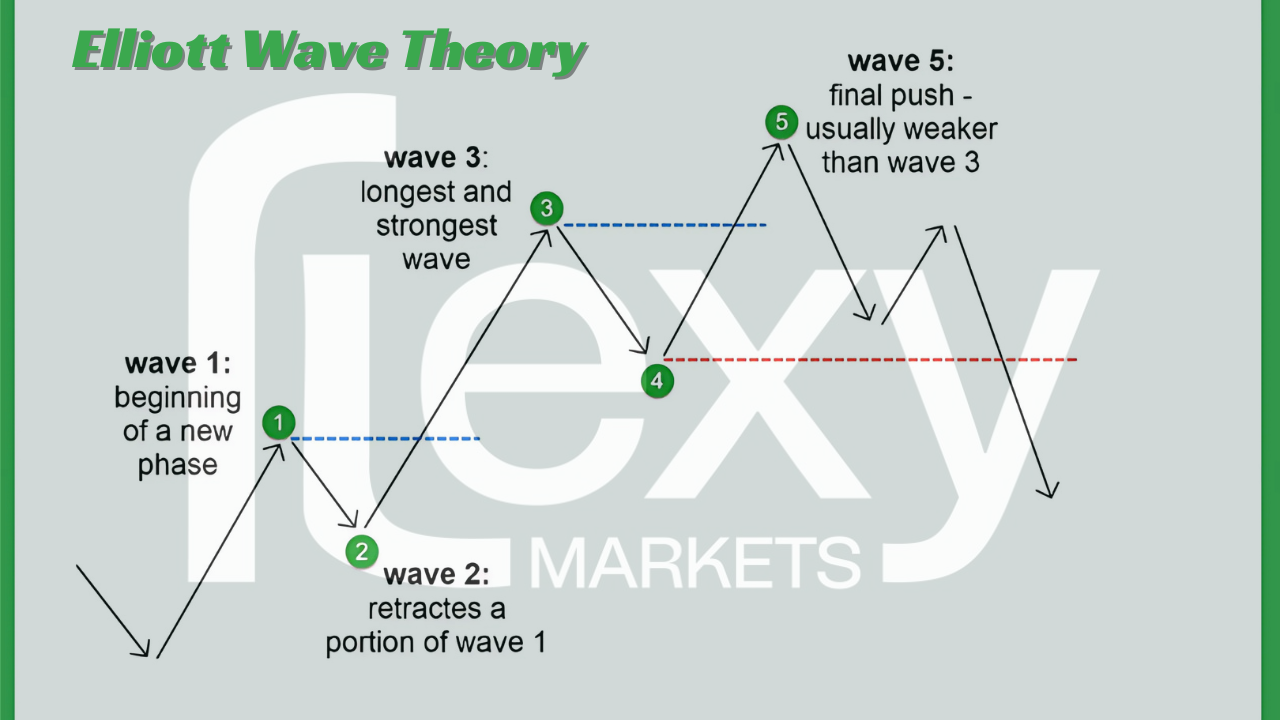

Elliott Wave Theory is a popular technical analysis method used by traders to forecast market trends by analyzing recurring price patterns. Introduced by Ralph Nelson Elliott in the 1930s, this theory is based on the idea that market movements follow predictable cycles influenced by crowd psychology. Today, it remains a crucial tool for traders in forex, stocks, and cryptocurrency markets.

In this blog, we’ll explore the fundamentals of Elliott Wave Theory, how it works, and practical ways to apply it in trading.

Elliott Wave Theory is based on the concept that financial markets move in repetitive cycles, driven by the collective behavior of traders. These cycles consist of five-wave patterns in the direction of the trend (impulse waves) followed by three-wave corrections (corrective waves).

Impulse Waves (5-Wave Pattern):

Corrective Waves (3-Wave Pattern):

Understanding these patterns helps traders anticipate market trends and make better trading decisions.

Elliott Wave Theory follows a structured set of rules that traders use to analyze price movements. Here are the key rules:

By identifying these patterns, traders can predict potential market reversals and plan their trades accordingly.

Elliott Wave Theory helps traders recognize the beginning and end of market trends. By identifying impulse and corrective waves, traders can enter trades at the right time and avoid unnecessary risks.

Fibonacci retracement levels play a crucial role in Elliott Wave analysis. Common Fibonacci levels (38.2%, 50%, and 61.8%) help traders identify potential reversal points and entry zones.

By analyzing wave structures, traders can set stop-loss and take-profit levels strategically. For example, placing a stop-loss below Wave 2 ensures risk management if the market does not follow the expected pattern.

For better accuracy, traders often combine Elliott Wave analysis with:

Moving Averages (to confirm trends)

RSI (Relative Strength Index) (to spot overbought or oversold conditions)

MACD (Moving Average Convergence Divergence) (to identify trend strength)

Elliott Wave Theory works on multiple timeframes, from intraday charts to long-term trends. Day traders can use it for short-term price movements, while long-term investors apply it to identify major market cycles.

Despite its effectiveness, Elliott Wave Theory has some challenges:

To overcome these challenges, traders should practice with historical data, use additional technical tools, and follow market news for better decision-making.

Conclusion

Elliott Wave Theory is a valuable tool for predicting market movements and improving trading strategies. By understanding impulse and corrective waves, traders can make informed decisions, manage risk effectively, and increase profitability. While it requires time and practice to master, combining Elliott Wave analysis with other technical indicators enhances its accuracy.

If you’re looking to enhance your trading skills, start practicing Elliott Wave analysis and integrate it into your trading plan today!

Comments

No comments yet. Be the first to comment!

Leave a Comment