By: Rimi

Published on: Apr 10, 2025

Asian stocks surged, Treasury yields swung, and commodities stabilized as global markets experienced a dramatic rebound following US President Donald Trump’s decision to pause reciprocal tariffs. Here’s a breakdown of the key developments shaping financial markets and what they mean for investors.

Asian equities soared on Thursday, marking their largest single-day gain since 2021, as investors cheered Trump’s temporary suspension of reciprocal tariffs on key trading partners. The relief rally came after weeks of turmoil that wiped out $10 trillion from global equity markets.

Japan’s Topix Index surged 7.5%, its best day in a decade.

Hong Kong’s Hang Seng climbed 1.8%, while China’s Shanghai Composite rose 0.9%.

Australia’s S&P/ASX 200 jumped 4.7%, driven by banking and mining stocks.

The rally mirrored the S&P 500’s 4.9% gain on Wednesday, its strongest performance since the 2008 financial crisis. However, US equity futures dipped 0.8% in Asian trading, signaling lingering uncertainty.

President Trump announced a 90-day pause on reciprocal tariffs targeting allies like the EU and Japan, rolling back rates to 10% from the planned 25%. However, China faced heightened levies of 125%, including Hong Kong and Macau, escalating tensions with Beijing.

Market analysts speculate that the plunge in Treasury prices and warnings from Wall Street leaders like JPMorgan’s Jamie Dimon about a potential recession pressured the White House.

“Trump blinked under market pressure,” said Homin Lee, Senior Macro Strategist at Lombard Odier. “The tariff hike on China is symbolic, but the pause buys time for negotiations.”

The US Treasury market, which saw yields spike 34 basis points over three days, regained footing after a turbulent week.

10-year Treasury yields fell 6 basis points to 4.27%.

A $39 billion 10-year note auction saw robust demand, easing fears of foreign investor retreat.

Despite the rebound, traders brace for volatility. “This instability will persist for weeks,” warned Tsutomu Soma of Monex Inc. “No one knows how tariffs will shape yields.”

Chinese stocks advanced on expectations that Beijing will roll out new economic stimulus measures to counter Trump’s tariffs. The Politburo is set to discuss support for industries like tech and manufacturing.

However, the onshore yuan fell to a 16-year low (7.35 per dollar) as traders priced in potential rate cuts by the People’s Bank of China (PBOC).

“Asia’s export-driven economies dodged a bullet,” said HSBC’s Frederic Neumann. “Delayed tariffs offer breathing room, but China’s path remains rocky.”

European markets geared up for a rebound:

Euro Stoxx 50 futures jumped 8.1%.

Metals like copper halted a 12-day losing streak, while gold rose 1.4% to $3,125/oz as a safe-haven play.

Oil prices slipped 1.4% to $61.50/barrel amid doubts over OPEC+ supply discipline and tariff impacts on global demand.

S&P 500 Futures: -0.8%

Euro Stoxx 50 Futures: +8.1%

Topix (Japan): +7.5%

USD/JPY: -0.8% to 146.54

Offshore Yuan: Steady at 7.3519

US 10-Year Yield: 4.27% (-6 bps)

Australia 10-Year Yield: 4.29% (-10 bps)

Tariff Uncertainty Persists: While the tariff pause alleviates immediate pressure, the 125% levy on China keeps trade war risks alive. Investors will watch for Beijing’s retaliation and stimulus details.

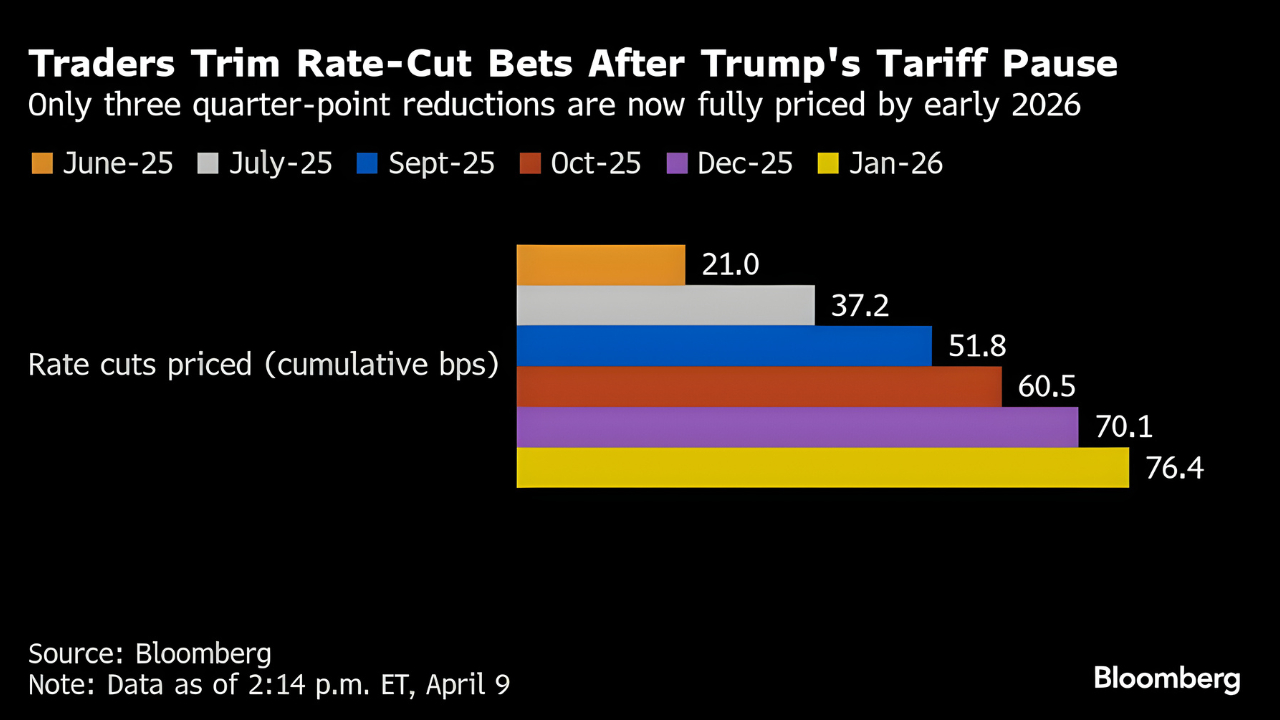

Bond Market Vigilance: Treasury volatility may continue as traders assess Fed policy and foreign demand. A successful 30-year auction on Thursday could further stabilize yields.

Commodity Risks: Oil and metals face headwinds from slower global growth, but gold’s rally highlights lingering risk aversion.

The temporary tariff truce has injected optimism into equities, but underlying tensions with China and bond market instability suggest the rally could be short-lived. Investors should brace for:

Heightened Volatility: Trade headlines and Treasury swings will dominate sentiment.

Policy Responses: Central bank moves, especially from the PBOC and Fed, will be critical.

Sector Opportunities: Tech, green energy, and defensive assets like gold may outperform.

As markets hang in the balance, one thing is clear: The only certainty is uncertainty.

Comments

No comments yet. Be the first to comment!

Leave a Comment