By: Aditi

Published on: Mar 15, 2025

As investors brace for a week packed with central bank decisions and trade tariff developments, earnings season continues to deliver critical insights into corporate performance. Among the companies set to report, Tencent (0700.HK), Micron (MU), Nike (NKE), Prudential (PRU.L), and JD Wetherspoon (JDW.L) stand out as stocks to watch. This earnings preview dives into what analysts expect and the factors that could sway these companies’ stock prices in the days ahead.

Key Focus: AI Innovation and Financial Growth

Chinese tech titan Tencent is poised to release its annual results amid escalating competition in artificial intelligence (AI). Recently, the company unveiled its Hunyuan Turbo S model, boasting faster response times than DeepSeek’s R1 model. Tencent claims this AI tool reduces “first-word delay” by 44%, a critical edge in real-time applications like customer service and cloud computing.

Previous Performance:

What to Watch:

Analyst Takeaway: With AI driving operational efficiency, Tencent’s ability to sustain growth in a competitive landscape will be pivotal.

Key Focus: Semiconductor Demand and Guidance

Micron, a leading U.S. semiconductor manufacturer, faces scrutiny after its Q1 outlook disappointed Wall Street. While the company beat Q1 earnings estimates (1.79EPSvs.1.79EPSvs.0.95 loss YoY), its Q2 revenue guidance of 7.9billion(±7.9billion(±200 million) fell short of expectations.

Challenges Ahead:

What to Watch:

Analyst Takeaway: Clear guidance on AI-related revenue and inventory management will dictate short-term investor sentiment.

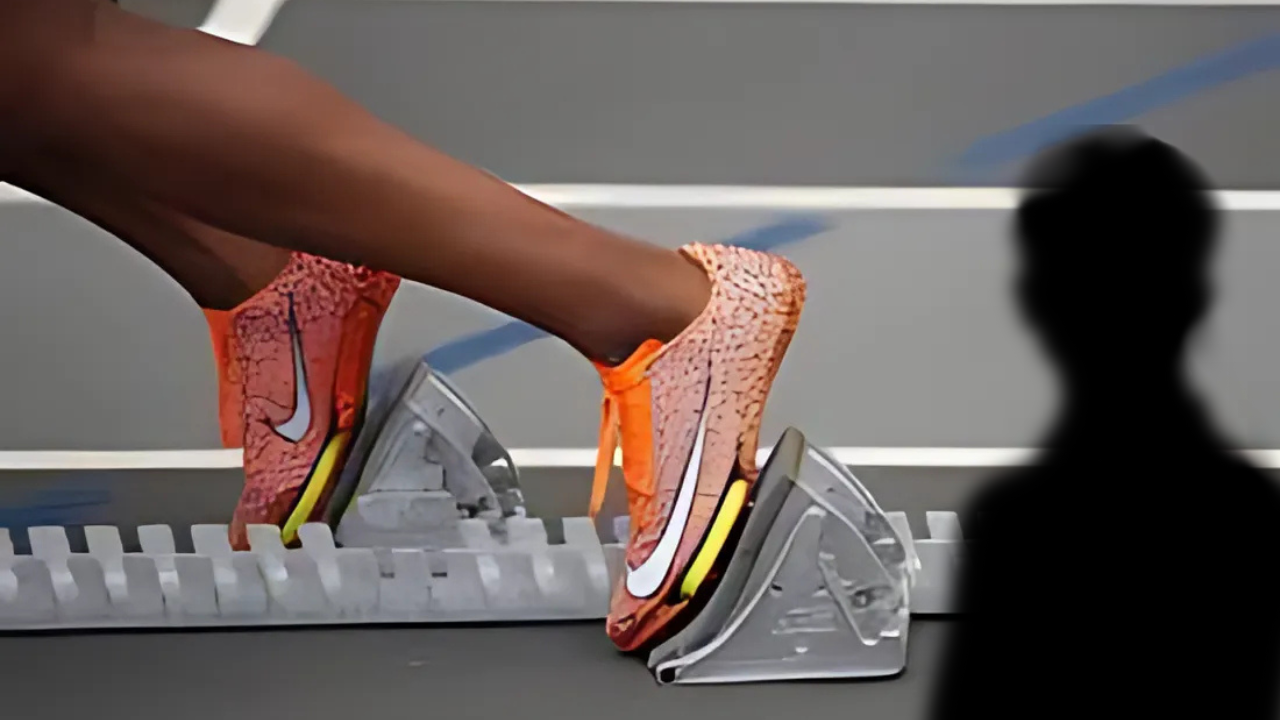

Key Focus: Turnaround Efforts and Brand Strategy

Nike enters its Q3 report under pressure as CEO Elliott Hill spearheads a turnaround. A recent collaboration with Kim Kardashian’s Skims signals efforts to reinvigorate its women’s apparel line, but challenges persist.

Recent Performance:

What to Watch:

Analyst Takeaway: Nike’s ability to balance brand investment with profitability—while fending off rivals like On Holding and Lululemon—will be critical.

Key Focus: Asian Market Growth and Potential IPO

The FTSE 100 insurer Prudential faces headwinds from China’s economic slowdown but is eyeing growth in Asia and Africa. A potential IPO of its Indian venture, ICICI Prudential Asset Management, could unlock significant value.

Strategic Goals:

What to Watch:

Analyst Takeaway: Updates on surplus capital and the ICICI listing timeline will influence investor confidence.

Key Focus: Labor Costs and Consumer Spending

Pub chain JD Wetherspoon grapples with a £60 million annual cost increase from April’s minimum wage hike. Chairman Tim Martin has criticized the government’s “tax discrepancy” favoring supermarkets over pubs.

Recent Metrics:

What to Watch:

Analyst Takeaway: Commentary on mitigating cost pressures and holiday season sales trends will be key.

While not directly tied to earnings, escalating U.S.-China trade tensions loom over global markets. Former President Trump’s proposed tariffs on Canadian and EU goods underscore geopolitical risks that could impact tech (Tencent, Micron) and consumer sectors (Nike). Investors should monitor trade policy developments for ripple effects.

Next week’s earnings reports will test resilience across sectors:

Comments

No comments yet. Be the first to comment!

Leave a Comment