By: Swarnalata

Published on: Mar 17, 2025

The stock market is buzzing with activity as major companies like Nvidia, Berkshire Hathaway, Baidu, QinetiQ, and AstraZeneca make headlines. From AI advancements to acquisitions and profit warnings, here’s a breakdown of the latest updates and what they mean for investors.

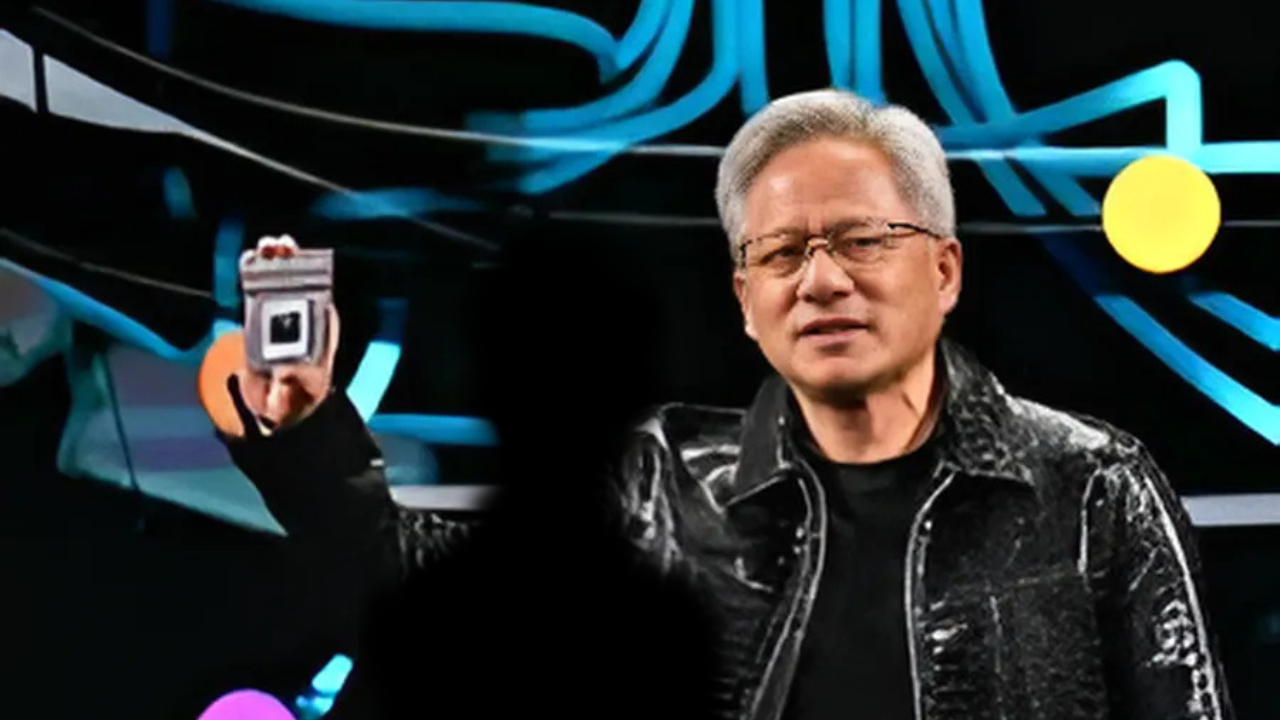

Nvidia (NVDA) kicked off its annual GPU Technology Conference (GTC) on Monday, with a strong focus on artificial intelligence (AI) and quantum computing. Investors are eagerly awaiting key product announcements, including a keynote speech by CEO Jensen Huang on Tuesday.

Nvidia’s shares surged over 5% on Friday, capping a volatile week for US stocks. However, the stock is down 9.4% year-to-date, partly due to DeepSeek’s release of a lower-cost AI model in January, which raised questions about tech spending.

Pre-market trading on Monday saw Nvidia shares rise 1%, while quantum computing stocks like Rigetti Computing (RGTI) and Quantum Computing Inc. (QUBT) also gained momentum.

Key Takeaway: Nvidia remains a leader in AI and quantum computing, but competition and market volatility are key factors to watch.

Warren Buffett’s Berkshire Hathaway (BRK-B) has increased its stakes in Japan’s largest trading houses, including Mitsubishi Corp., Marubeni Corp., Mitsui & Co., Itochu Corp., and Sumitomo Corp. The average position across these stocks now stands at 9.3%.

This move comes as Japan’s Nikkei 225 index struggles, down over 6% year-to-date. Analysts suggest Berkshire’s increased positions could provide stability and confidence in Japanese markets.

Key Takeaway: Berkshire’s strategic investments in Japan highlight its long-term confidence in the region’s economic potential.

Chinese tech giant Baidu (9888.HK) has launched two new AI models, ERNIE X1 and ERNIE 4.5, intensifying competition in the AI space. The ERNIE X1 model reportedly matches DeepSeek’s R1 performance at half the cost, while ERNIE 4.5 boasts advanced multimodal understanding and language capabilities.

Baidu isn’t alone in this race. Tencent (0700.HK) has also released its Hunyuan Turbo S model, claiming faster response times than DeepSeek’s R1.

Key Takeaway: Baidu’s innovations underscore the growing competition in AI, with Chinese tech firms vying for dominance.

UK-based defence firm QinetiQ (QQ.L) saw its shares plummet 20% after issuing a profit warning. The company now expects organic revenue growth of around 2% in 2025, down from previous guidance of “high single-digit” growth.

A goodwill impairment charge of £140 million ($181 million) and one-off exceptional charges of up to £40 million have further impacted its balance sheet. The profit warning has also affected other UK defence stocks, including BAE Systems and Chemring.

Key Takeaway: Even sectors with strong growth potential, like defence, face challenges, reminding investors to stay cautious.

Pharmaceutical giant AstraZeneca (AZN.L) announced its acquisition of cell therapy specialist EsoBiotec for up to $1 billion (£771 million). EsoBiotec’s platform aims to revolutionize cancer treatment by enabling faster delivery of cell therapies.

While the acquisition is relatively small for AstraZeneca, it aligns with the company’s strategy to diversify its portfolio. Additionally, the EU approval of its immunotherapy drug Imfinzi for a rare lung cancer type and positive trial results for Eneboparatide highlight its growth potential.

Key Takeaway: AstraZeneca’s strategic acquisitions and drug approvals reinforce its position as a leader in the pharmaceutical industry.

The latest updates from Nvidia, Berkshire Hathaway, Baidu, QinetiQ, and AstraZeneca highlight key trends in AI, quantum computing, defence, and pharmaceuticals. While opportunities abound, market volatility and competition remain critical factors for investors to consider.

Stay tuned for more updates on these trending stocks and their impact on global markets.

Comments

No comments yet. Be the first to comment!

Leave a Comment